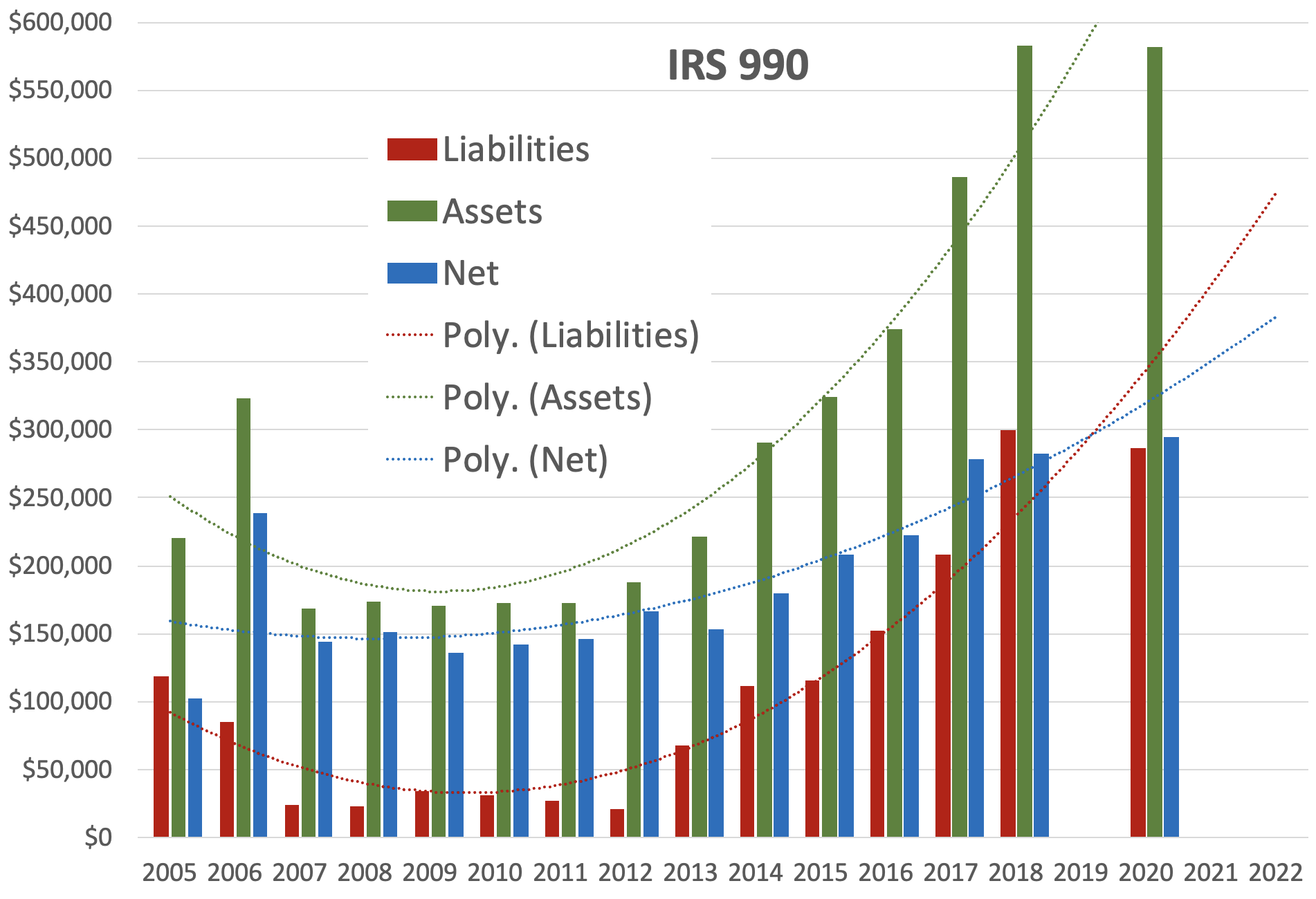

As a corporation who has received tax exempt status as a not-for-profit “social club” under the Internal Revenue Code 501(c)(7), the Club is required to file an IRS Form 990 each year that describes, among other things, its assets, liabilities and net worth. Once submitted, these forms are publicly available from the IRS and other data aggregators. Beyond financial data, the IRS Form 990 solicits additional organizational information to ensure that the Club continues to qualify as a not-for-profit corporation. One question on the form asks if the Club amended its By-Laws that year. Since 2005, the Club has checked “No” in this box, despite the fact the By-Laws currently on the web site bear a revision date in 2010. Additionally, but only from 2005 through 2008, the Club reported its number of members.

At recent membership meetings, the Club leadership has claimed it is approaching financial insolvency. The data on Club IRS Forms 990 seems to contradict that claim, at least through fiscal year 2018. The Form 990 for 2018 was filed in November 2019, but the Form 990 for 2019 was apparently never filed.

It is also noteworthy that the Club has – for decades – filed with the IRS as a not-for-profit “social club” under the Internal Revenue Code 501(c)(7). But it is also conspicuous that the Club has also filed annual reports as a “profit corporation” with the State of Florida (see the Florida information page). However, there is no disputing the fact that the Club is declared as not-for-profit corporation in the By-Laws and is recognized as such by the Internal Revenue Service. As late as November 22, 2022, the Club affirmed the non-profit nature of the Club in Federal Court; The Club’s lawyer filed a motion in Federal Bankruptcy Court declaring that the Club is – in fact – a tax exempt not-for-profit organization:

“3. Debtor is a tax exempt, not-for-profit entity that operates a flying club for the benefit of its members, which includes the ownership, operation and lease of aircraft flown by its members.” – Craig A. Pugatch and Jason E. Slatkin, Esq.

The Club’s current leadership is aware of this discrepancy and has taken no action to explain or correct it, apparently instead preferring to spend money on protracted litigation toward current and past Club leaders and members.

Finally, it is conspicuous that the draft minutes for the August 11, 2021 Club Meeting summarized comments from the Treasurer suggesting the IRS has fined the Club $10,000 for failing to file its 2019 IRS Form 990 (the deadline was May 15, 2020) and has apparently informed the Club that its IRS Form 990 for 2020 is also overdue (was due May 15, 2021) which could mean more fines:

“We are […] having an issue with taxes.” The Club “accrued $10k fine and possible could carry over into 2020. We are working with a tax accounting company and hope to solve this soon.”

| Filed | Year | IRS Form | Liabilities | Assets | Net Value |

|---|---|---|---|---|---|

| not filed | 2022 | missing | |||

| not filed | 2021 | missing | |||

| 2022-04-22 | 2020 | Form 990: 2020 Filed late. | $286,806 | $581,794 | $294,988 |

| not filed | 2019 | missing | |||

| 2019-11-15 | 2018 | Form 990: 2018 | $ 299,477 | $ 582,407 | $ 282,930 |

| 2018-09-16 | 2017 | Form 990: 2017 | $ 208,019 | $ 486,437 | $ 278,418 |

| 2018-01-01 | 2016 | Form 990: 2016 | $ 151,992 | $ 374,024 | $ 222,032 |

| 2016-09-20 | 2015 | Form 990: 2015 | $ 116,053 | $ 324,125 | $ 208,072 |

| 2015-03-15 | 2014 | Form 990: 2014 | $ 111,571 | $ 290,952 | $ 179,381 |

| 2014-03-07 | 2013 | Form 990: 2013 | $ 67,933 | $ 221,371 | $ 153,438 |

| 2013-03-01 | 2012 | Form 990: 2012 | $ 21,271 | $ 187,397 | $ 166,126 |

| 2012-03-22 | 2011 | Form 990: 2011 | $ 26,740 | $ 172,485 | $ 145,745 |

| 2011-03-08 | 2010 | Form 990: 2010 | $ 30,894 | $ 172,655 | $ 141,761 |

| 2010-03-01 | 2009 | Form 990: 2009 | $ 34,372 | $ 170,226 | $ 135,854 |

| 2009-01-16 | 2008 | Form 990: 2008 | $ 22,799 | $ 173,851 | $ 151,052 |

| 2008-05-30 | 2007 | Form 990: 2007 | $ 23,957 | $ 168,199 | $ 144,242 |

| 2007-03-12 | 2006 | Form 990: 2006 | $ 84,716 | $ 323,079 | $ 238,363 |

| 2006-02-24 | 2005 | Form 990: 2005 | $ 118,359 | $ 220,297 | $ 101,938 |